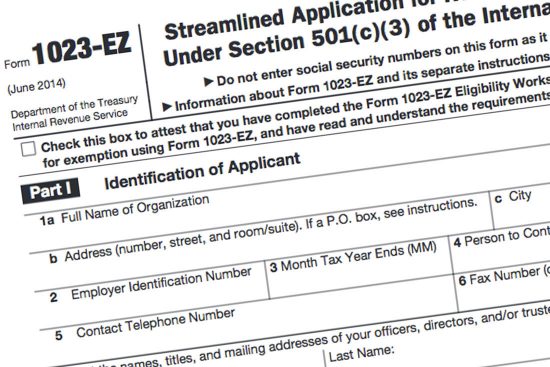

IRS Suspends Mailing

March 25, 2022 IRS Suspends Mailing The IRS is suspending the issuance of several notices generally mailed to tax-exempt or governmental entities in case of a delinquent return. Due to the historic pandemic, the IRS hasn’t yet processed several million returns filed by individuals and entities. The suspension of the notices will help avoid confusion […]

IRS Suspends Mailing Read More »