Cost sharing or matching is the financial support contributed by organizations to sponsored projects. Compliance with federal cost accounting standards requires that cost-shared expenses be treated in a consistent and uniform manner in proposal preparation, award negotiation and the accounting of these expenses in the financial reports to sponsors.

Your organization should assume a cost-sharing commitment only when required by the sponsor or by the competitive nature of the award, and then to cost share only to the extent necessary to meet the specific requirements. Why, because cost sharing will require you to raise additional funds to cover the cost not paid by the funding source. This can be a stretch especially for newer organizations, so if at all possible you should only utilize grants with cost sharing where the organization can identify how the cost match or sharing will be met.

Cost sharing commitments frequently consist of administrative salaries (with related staff benefits) and the associated indirect costs. All cost-sharing commitments should have prior approval of the Board of Directors prior to the submission of a budget to the sponsor. Project Directors are urged to discuss proposed cost-sharing commitments with the Executive Director and Finance manager well in advance of the submission deadlines to avoid “eleventh hour” problems and misunderstandings.

The cost-sharing requirements of sponsors vary. Grants often are viewed as a form of financial assistance, and some sponsors consider it necessary to obtain cost-sharing to ensure that the organization has a commitment to the proposed project. Nonprofit organizations generally will seek cost sharing when it is known that the funding for the project will not cover all the costs involved in meeting the mission or goals of the project (e.g., administrative time, staff benefits, indirect cost, etc.). Some sponsors do not require cost sharing. In the case of federal research proposals, cost-sharing is not expected, nor can it be used in the review process, unless a cost sharing requirement is allowed under the awarding agency’s regulations and specified in a notice of funding opportunity (see 2 CFR 200.306).

Any cost-sharing included in an award budget is a condition of the award and is subject to audit. It is most important, therefore, that any cost-sharing commitments be reflected in the project accounts once an award is received.

The federal Uniform Guidance (2 CFR 200.306) states that:

“For all Federal awards, any shared costs or matching funds and all contributions, including cash and third party in-kind contributions, must be accepted as part of the non-Federal entity’s cost sharing or matching when such contributions meet all of the following criteria:

(1) Are verifiable from the non-Federal entity’s records;

(2) Are not included as contributions for any other Federal award;

(3) Are necessary and reasonable for accomplishment of project or program objectives;

(4) Are not paid by the Federal government under another Federal award, except where the Federal statute authorizing a program specifically provides that Federal funds made available for such program can be applied to matching or cost sharing requirements of other Federal programs;

(5) Are provided for in the approved budget when required by the Federal awarding agency; and

Unrecovered indirect costs, including indirect costs on cost sharing or matching may be included as part of cost sharing or matching only with the prior approval of the Federal awarding agency. Un-recovered indirect cost means the difference between the amount charged to the Federal award and the amount which could have been to the Federal award under the non-Federal entity’s approved negotiated indirect cost rate.”

Cost sharing will be considered a specific commitment and mandatory in terms of subsequent documentation requirements when it is a stated requirement of the sponsoring agency or is considered significant to the negotiation of the award. The organization can consider a cost-sharing commitment to be significant if it is explicitly set forth as a condition of the award agreement.

To meet the reporting and auditing requirements of the sponsoring agencies, cost-sharing commitments must be charged either to a separate cost-sharing account related to the specified project or to the sponsored project account. Cost-sharing commitments for administrative and staff salaries, benefits, materials and supplies, travel, printing, and other operating costs should be recorded in a cost-sharing account. (See sample class list, Grant Management Non Profit Fund Accounting Book).

For example, the Project Directors’ salary cost share is 15% of his or her time in support of a sponsored training project. This commitment should be charged to the assigned cost-sharing account where the remaining 85% is charged as a covered or reimbursable expense directly to the program.

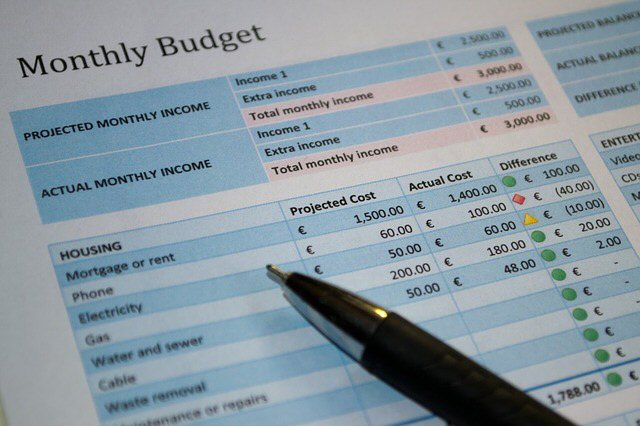

The time and effort of the managers and staff designated as part of the cost-sharing commitment should be closely monitored. Periodic budget reviews (budget/actual) will determine if appropriate salary and other charges are being made to the cost-sharing account.

The appropriate actions must be taken ensure the efforts are accounted for and recorded properly.

Your Fiscal Policies manual should define the procedures that will ensure that all of the project costs–those costs covered by the sponsor and those committed by the organization as cost-sharing–are recorded in the sponsored project account and/or the associated cost-sharing account and reflect the budget commitments approved by the sponsor and agreed to by the organization at the time of the award. This consistency between budget commitment and expenditures is essential to ensure compliance with federal cost accounting standards.

Voluntary uncommitted cost-sharing is cost-sharing provided by the organization that is not explicitly quantified in the proposal budget or ensuing award document. As a result, it is not required as a condition of the award, will not be reflected in the final budget agreement between the organization and the sponsoring agency, and therefore, is not identified in the organization’s accounting and personnel records. Examples of voluntary uncommitted cost-sharing include statements in the proposal narrative that identify the available capacity and facilities of the organization to carry out the proposed mission. When cost-sharing is not a specified requirement of the sponsor, it may be desirable to reflect an “anticipated supporting commitment (not auditable)” in lieu of cost-sharing. Such a commitment is not considered a part of the proposed budget.

Examples of the cost sharing or matching principle:

Executive Salary

The organizations ‘executive director earns a bi-weekly salary of $2500. The organization currently has 5 programs in which the director spends 10% of his/her time overseeing the programs and the allocation has been approved by each funding source/sponsor. Programs 1 and 3 require a 30% cost share or match.

Please note that all expenses regardless of its’ allocation are substantiated by the time and effort report (T & E). See sample reports in the Grant Management Non Profit Fund Accounting Book.

50% of his/her time has been approved by each of the funding sources/sponsors to be charged as an indirect cost (administrative) to the program and covered by the grant. (10% for each of the 5 Programs)

Based on his/her time and effort report the required match of 30% of his/her time is spent on other indirect program expenses, these are expenses that benefit the projects but is not necessarily required for the program to operate or meet its’ mission. These costs will benefit the organization as a whole and are considered cost sharing or matching.

This 30% match is a requirement for Programs 1 & 3 but the time and effort report shows that this time (30%) was spent for all the programs for this pay period. It can vary by pay period based on actual time reported on the T & E report.

It has also been determined (T & E) that he/she spent 5% of time on fundraising and 15% on general administration for the organization (board meetings, check signing, sponsor required meetings, etc).

The salary allocations for the executive director will be recorded as follows for the current pay period:

| Debit | Credit | Explanation | ||||

| Salaries and Wages | 72010-10 | 250.00 | Program 1 | |||

| 72010-12 | 150.00 | Program 1 Match | ||||

| 72010-20 | 250.00 | Program 2 | ||||

| 72010-22 | 150.00 | Program 2 Match | ||||

| 72010-30 | 250.00 | Program 3 | ||||

| 72010-32 | 150.00 | Program 3 Match | ||||

| 72010-40 | 250.00 | Program 4 | ||||

| 72010-42 | 150.00 | Program 4 Match | ||||

| 72010-50 | 250.00 | Program 5 | ||||

| 72050-52 | 150.00 | Program 5 Match | ||||

| 75010-00 | 125.00 | Fundraising | ||||

| 70000-00 | 375.00 | Administrative | ||||

| Accrued Salaries | 21020-00 | 2,500.00 | ||||

| 2,500.00 | 2,500.00 | |||||

Benefits and payroll taxes are recorded with the same allocated percentages but is based on the approved budget. Not all sponsors/funding sources will always cover all the benefits and payroll taxes but your proposal should ensure that if not all, as much of these expenses as possible are covered by the grant.

Salaries and Wages for other positions are allocated based on the same method. Generally program director and direct staffing compensations are a direct cost to the programs based on the time spent on each project. Your budget will reflect the expected time each staff person will spend on a particular project or program but the actual time will be based on the T & E Report.

Staff should be aware of the time approved and allocated in the budget for each program and should be mindful of the time they are required to spend on the project. These budgeted timelines are designed to ensure the program is run efficiently and that the mission of the program is met.

When there are variations, the periodic budget/actual review should identify any variances in the budget to actual for all line items and a determination will need to be made as to if the time can be allocated to the grant prior to the end of the grant period or if a budget revision is required. (See Budget Revisions in Grant Management Non Profit Fund Accounting Book).

This should give you a good idea of how cost sharing/matching will be recorded on your books and what cost sharing/matching means in a non-profit environment. We are not here to teach accounting but to cover some examples of how certain transactions should be handled and what is expected from the funding source/sponsor in this regard.

Resource for Fiscal Compliance

You will find this book to be invaluable when setting up and maintaining your systems for non-profit finance, compliance and reporting and organizational status reports to your Board of Directors and other interested parties. In addition to performing deliverables, as specified in your program plan, timely and effectively, you should not have to worry about discontinued funding due to non-compliance.