And why the answer is “Yes”

(Excerpts credit Nonprofit Assistance Fund)

In my consulting business in the non-profit sector a recurring concern is found where a nonprofit’s accounting system may not have been put together in a manner that supports the reporting and accountability requirement of such an organization, in fact that is why I wrote my book and started this blog.

This lack of foresight or knowledge results in a system that is not compliant with non-profit reporting regulations, does not show a segregation of programs or projects and the related costs and do not follow many of the non-profit requirements of accounting for funds received.

In no way am I criticizing people who are out there making a difference in their communities working and managing nonprofits. Most people who started working in the nonprofit sector did not do it because they like accounting and filling out reports after reports, after reports. Most people go into the business because they care about the mission, making a difference, building communities, and many other reasons.

Some are overwhelmed when they realize just how much regulation, filing and paperwork comes with a tax exempt status. Organizations that ignore their accounting systems do so at their own risk. At some time a funder or even the IRS will ask for financial reports that will show how the funds were spent, the health of the organization as a whole, the allocation methods used for direct and indirect costs and other factors of concern that accurate financial statements will provide.

Getting that answer and the answers to other questions such as, “How much did we spend of Funder A’s grant?” or, “What is the total cost of that program, including all of the allocated costs?” greatly depends on how well your accounting system is set up, maintained and utilized.

When, not if, you are asked for this information, the more time you spend trying to piece the information together the less time you have fulfilling your goals and missions in serving the community. Pulling this information together to meet a deadline can be a daunting task and could come down to the question of whether you will get continued funding or any new funding.

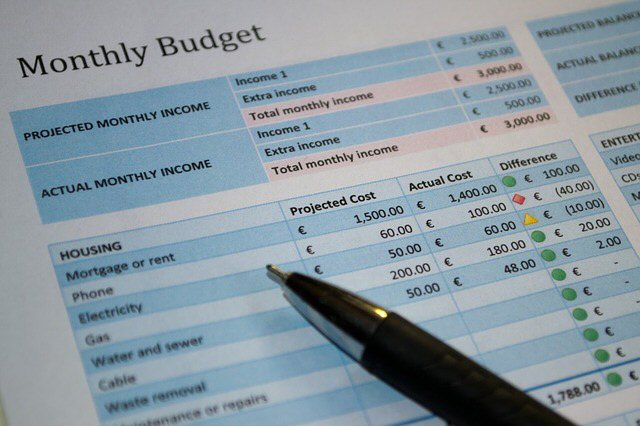

I do not endorse any particular accounting software and excel can work for a while or when you are just starting out but good accounting software will become a must if you are to succeed.

In my book “Grant Management Non-Profit Fund Accounting” I specifically use QuickBooks for the examples because so many small non-profits have been lead to use it. I highlighted some of the QB caveats to save bookkeepers and accountants time in searching the software for what are common accounting and finance reports and processes that are expected from an accounting software package that QB lacks, at least as of the printing of the book.

Bottom line is, the harder it is to compile good financial information, the greater the likelihood of it not being as accurate as it should be. You can’t figure out what you are going to do financially if you don’t know where you stand right now. Good cash flow planning and budgeting can only be done if you have a system in place that can get you usable information in a timely manner.

This isn’t to say that every nonprofit needs a CPA on staff (although I think it would be great if every nonprofit had an Accountant or CPA who knows nonprofits on their board), but the person keeping the books should have some familiarity with nonprofit accounting processes and conventions. I have worked with more than a few nonprofits who have realized their systems need help, systems that were set up by well-meaning people but are not able to give them the management information they needed to run the organization. Once a good accounting system is in place and people are trained to use it correctly, it should be relatively worry free.

Doing it right the first time saves a lot of frustration in the end. Believe me, I have consulted with too many agencies who waited too late and lost their funding for continued and new operations. If you don’t start right it may become a time where not even the best accountant or CPA can save your organization.

Here is an article from Nonprofit Assistance Fund titled “Help! We need an accounting system!” This article is from 2007 but it is still reverent today and while you’re there you may find other information that you can use.