FINANCIAL MANAGEMENT GUIDELINES FOR NON-PROFIT AGENCIES Part 1

Everyone in your organization who is responsible for grant management should be familiar with the processes and procedures concerning accountability and responsibilities. This includes those who prepare grant proposals and those who record and report on grant project activities.

These guidelines regarding fiscal accountability are only intended to provide practical information on what is expected from organizations that have or anticipate receiving grants from federal funding either directly or as a sub-recipient.

This guide is not presented as a complete manual of procedures on grant administration. General information on other topics related to grant administration may be obtained by referring to the regulations in the Office of Management and Budget’s Guidance on Grants and Agreements (OMB).

You will also find resources on the web for organizations that provide training on grant management.

The chapter “What the Award Letter means to You” in the Grant Management Non-profit Fund Accounting Book and the various examples of award letters shows that specifics pertaining to your grant are outlined in the award package. Recipients should carefully review the Grant Award Summary Sheet and all referenced requirements provided by the grantor to ensure continued compliance.

Acceptance of a grant creates a legal obligation on the part of the grantee to use the funds in accordance with the terms of the grant and to comply with the grant’s provisions and conditions. The grantee assumes full responsibility for the conduct of project activities and becomes accountable for meeting Federal standards in the areas of financial management, internal controls, audit, and reporting to the funding source.

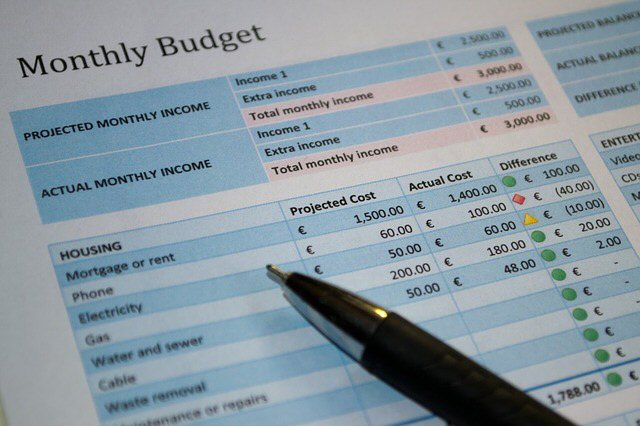

There are multiple methods for implementing financial management systems, and the organization should choose methods appropriate for its size, goals, and budget.

If the grantee organization is unable to meet the standards that are required from the grantor funding may be terminated and the organization may be deemed ineligible to receive subsequent financial assistance or may have more oversight for future awards. Increased oversight might include requirements that payments be reimbursements or documentation supporting project costs be submitted more often than usual for that particular type of grant.

Click on titles below for our posts on some guidelines on non-profit accounting and compliance.

• Do you need an Accounting System

• Budgeting tasks for your non-profit

• Financial reports for non-profit compliance

• What internal financial controls are recommended

• Fund Accounting non-profit expenses

• Effectively managing grant activities

• What is fund accounting and its’ purpose

COST SHARE REPORTING

In addition to the information contained in the posts listed above cost sharing or matching may be required for some or all grants you receive. The cost sharing or matching costs may vary by grantor. It can be 10, 20, 50% of the total grant awarded. In some cases it may be an “equal match.” For example if a grantee receives $50,000 in grant funds, it must supply $50,000 to make total project costs $100,000.

Cost share funds may come from personnel costs, in-kind contributions, volunteers, or contributions of indirect costs and should correspond to the approved budget.

See the chapter on “Cost Sharing or Matching” in the Grant Management Non-Profit Accounting Book. In-kind contributions as well as volunteer hours should be recorded using the same methods as required for other expenses.

CONSORTIUM PROJECTS

What is a consortium: A consortium is a short-term arrangement in which several agencies pool their financial and human resources to undertake a large project that benefits all members of the group.

For consortium projects, the lead member is legally, financially, administratively, and programmatically responsible for all aspects of the award. The lead member submits the cash requests, prepares the reports, and if need be, handles the requests to amend the terms of the award. The lead agency on a consortium grant must include that grant in determining if it has met the threshold for a Single Federal audit and then maintain the appropriate documentation to support the annual audit.

Watch for FINANCIAL MANAGEMENT GUIDELINES Part 2