FINANCIAL MANAGEMENT GUIDELINES FOR NON-PROFIT AGENCIES Part 2

501 (c) (3) Fiscal Policies:

Click here for a downloadable link to example Fiscal Policies (PDF) adapted for non-profit sub-section 501 (C) (3) organizations.

This is presented as a guide to help you develop your fiscal policies. Some items and/or positions shown may not apply to you especially if you are just starting out; however it does not hurt to have all items incorporated in your fiscal policies so only minor modifications will be required as your organization grows and your funding increases. You may have an addendum that identifies responsibilities as of the date of the policy is established.

In addition, you may not currently have filled all the positions mentioned but you should identify who is or will be responsible for each action or requirement and make changes to your fiscal policies as your personnel and budget expands.

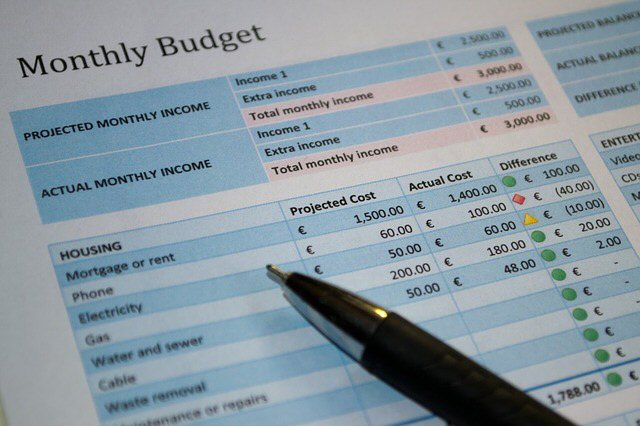

Currently, if your organization has funding that does not exceed $500,000 an audit by a CPA (Single Federal Audit) is not required. If your organization’s funding is $500k or above you should already be aware of the requirement to have a fiscal opinion completed by a CPA.

Make sure you incorporate a budgeted line item for this annual expense.

Regarding item 2 contained in the fiscal policies document:

Financial Responsibilities. The policies shown here are a model for a mature organization so you may not have established a finance committee, CFO and other high level positions as of yet; therefore the board that consists of at least a board president, secretary, and treasurer, with the CEO (possibly the organizer of the agency) will formulate the fiscal policies for the organization. The accountant might be retained on a contractual basis but is still accountable to the board of directors.

See the chapter on “Budgets” in the Grant Management Non-profit Fund Accounting Book for additional information on creating and maintaining your budgets including examples.

The book also covers the setup of the chart of accounts and account segregation, recording receipts and expenses and other pertinent information and examples, a great resource to ensure your organization has the basic covered.

Watch for FINANCIAL MANAGEMENT GUIDELINES Part 3