A nonprofit’s main focus is to carry out its mission to the best of its ability yet there’s one thing that cannot be lost in the desire to do good: A fiduciary responsibility to its funding sources and the community to use those resources efficiently and responsibly.

All nonprofits have three to four, depending on the type of organization, primary financial statements that they must submit to ensure compliance. These statements, which must be read together to have a complete picture of the organization are shown below.

- Statement of financial position (also called a balance sheet): This summarizes the assets, liabilities and net assets of the organization at a specified date. It’s a snapshot of the organization’s financial position on that date.

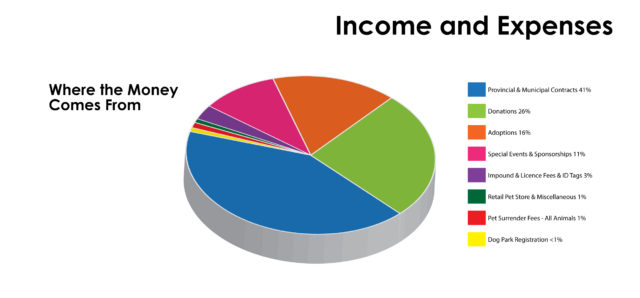

- Statement of activity (also called an income and expense statement): This reports the organization’s financial activity over a period of time. It shows income minus expenses, which results in either a profit or a loss.

- Statement of cash flow: This summarizes the resources that become available to the organization during the reporting period and the uses made of such resources. It’s especially useful in real-time because it reports income that has been received and expenses that have been paid. A statement of projected cash flow is helpful for the board and organization to be able to anticipate any shortfalls for planning purposes.

- Statement of functional expenses: Reports all expenses as related either to program services or to supporting services. Expenses under program services are shown divided among the various programs. Expenses under supporting services are generally divided between (1) management and general expenses and (2) fundraising expenses.

These reports are extremely important in terms of understanding your organization’s financial health and conveying that information to your board, (see earlier post for board responsibilities) you’ll also find that these types of reports will often be required by funders when applying for grants and/or reporting grant funds received.

Other reports, depending on your organization’s needs, are:

- Government information returns

- Payroll tax returns

- Reports to funders and management reports

- Budget/Actual reports

- Analysis of statements and investment reports

A detailed list of financial reports for nonprofits, and related definitions can be found in Financial Statements of Not-for-Profit Organizations, by the Financial Accounting Standards Board (www.fasb.org).

Accounting Basics

There are also a few accounting basics you should keep in mind. A qualified bookkeeper can help you to ensure reports are prepared properly and in a timely manner. He or she can also help to reconcile bank statements on a monthly basis, which is critical, and lend support and key information during budget development.

Good Habits

- Set up daily priorities. Knowing what you need to accomplish each day allows you to take care of the most important matters.

- Surround yourself with professional staff. Surrounding yourself with professionals eliminates the pettiness of daily office drama! Professionals are self-motivated and focused on doing their jobs, and they require minimum supervision.

- Keep your goals before you. To maintain a clear vision, keep your eyes on your goals. Post your vision or your goals in a place where they’re visible to you every day.

- Manage your time by planning and scheduling your daily activities. Be mindful of distractions that pull you away from completing your tasks, time management is crucial and a valuable asset both for you and your staff.

- Stay out of politics. Avoiding politics at work protects your nonprofit’s status.

Resource for Fiscal Compliance

You will find this book to be invaluable when setting up and maintaining your systems for non-profit finance, compliance and reporting and organizational status reports to your Board of Directors and other interested parties. In addition to performing deliverables, as specified in your program plan, timely and effectively, you should not have to worry about discontinued funding due to non-compliance.