Everyone in your organization who is responsible for grant management should take the time to review this book

to get a basic understanding of what is required to manage your grant and ensure the organization is in compliance with the grantor’s requirements.

This includes those who prepare grant proposals and those who record and report on grant project activities. This book is intended only to provide practical information on what is expected from grantee organizations in terms of fiscal accountability but it is invaluable to set the basic structure for accountability and processes in your organization..

Unless otherwise stated in the Grant Agreement acceptance of a grant creates a legal obligation on the part of the grantee to use the funds in accordance with the terms of the grant and to comply with the grant’s provisions and conditions.

The grantee thus assumes full responsibility for the accounting and of project activities and becomes accountable for meeting Federal standards in the areas of financial management, internal controls, audit, and reporting to the as required by the grantee.

This book is not intended as a complete manual of procedures on grant administration. General information on other topics related to grant administration may be obtained by referring to the regulations in the Office of Management and Budget’s Guidance (OMB) on Grants and Agreements. In addition, many for-profit and non-profit organizations offer training in the management of federal grants.

Specifics about each grant are included in the grant award package furnished to each grantee. We can’t stress enough the importance that the recipients carefully review the Grant Award Summary Sheet and all referenced requirements. (Examples are shown in the Grant Management Book).

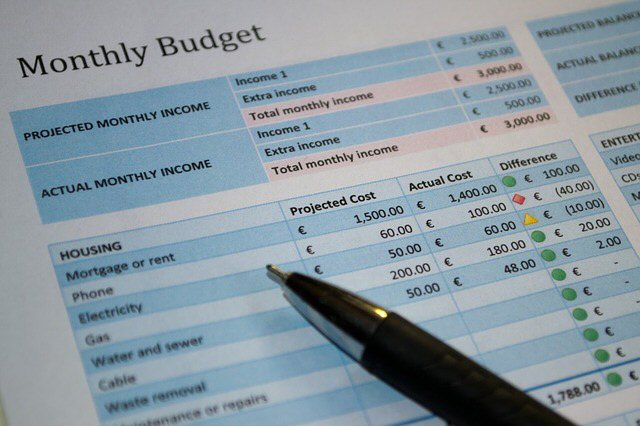

Many methods exist for implementing financial management systems, and the organization should choose methods appropriate for its particular scale of operations.

If the grantee organization is unable to meet the standards that are required funding may be terminated and the organization may be deemed ineligible to receive subsequent financial assistance or in some cases may have more oversight for future awards. Increased oversight might include requirements that payments be reimbursements rather than advances or documentation supporting project costs be submitted more regularly than normally required.

Tracking and Managing Restricted Funds

Bringing in a donation or being approved for a grant is always a good reason to celebrate, but if you don’t have processes in place for managing restricted funds, you can set yourself up for an administrative headache or legal action. Of course, we all would like our funds unrestricted but most of the time this is not the case, especially with federal grants.

Grantors and donors often have strong feelings and valid reasons for only providing restricted grants or designated gifts.

Tracking and managing those restricted contributions once they’ve been received comes with an added layer of administration. Being a good steward (and obeying the law, not knowing is not an excuse) means you need to understand when funds are restricted and make sure you are managing restricted funds as you spend them.

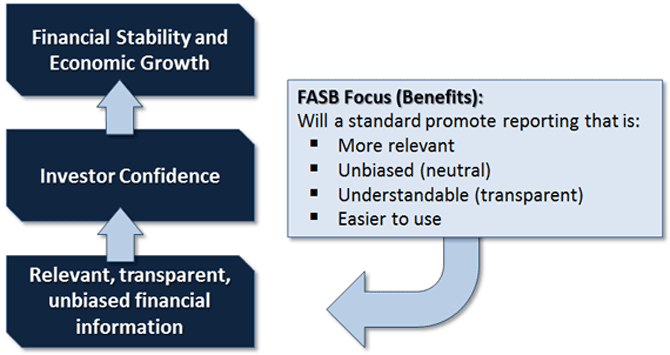

FASB

1996, the Financial Account Standards Board (FASB) issued the primary guidance relating to the recording of contribution revenue by nonprofit organizations (known as FASB116). Under these standards, all contributions must be classified as unrestricted, temporarily restricted or permanently restricted funds.

.

In August, 2016 FASB issued new accounting standards that is designed to help non-profits better tell their story through their financial statements.

Non-profit financial statements have been prepared under FASB’s current guidelines since 1993. The new standard changes presentation and disclosure requirements with the intention of helping non-profits provide more relevant information about their resources—and the changes in those resources—to donors, grantors, creditors, and other financial statement users.

These changes came about because stakeholders expressed concerns about the complexity, insufficient transparency, and limited usefulness of certain aspects of the current mode of presentation.

The updates are designed to simplify and improves how a non-profit organization classifies its net assets, as well as the information it presents in financial statements and notes about its liquidity, financial performance, and cash flows.

Accounting Standards Update No. 2016-14, Not-for-Profit Entities (Topic 958): Presentation of Financial Statements of Not-for-Profit Entities decreases the number of net asset classes from three to two. The new classes will be net assets with donor restrictions and net assets without donor restrictions.

These include qualitative and quantitative requirements in the following areas:

• Net Asset Classes

• Investment Return

• Expenses

• Liquidity and Availability of Resources

• Presentation of Operating Cash Flows.

The standard also:

• Requires reporting of the underwater amounts of donor-restricted endowment funds in net assets with donor restrictions and enhances disclosures about underwater endowments.

• Continues to allow preparers to choose between the direct method and indirect method for presenting operating cash flows, eliminating the requirement for those who use the direct method to perform reconciliation with the indirect method.

• Requires a not-for-profit to provide in the notes qualitative information on how it manages its liquid available resources and liquidity risks. Quantitative information that communicates the availability of a not-for-profit’s financial assets at the balance sheet date to meet cash needs for general expenditures within one year is required to be presented on the face of the financial statement and/or in the notes.

• Requires reporting of expenses by function and nature, as well as an analysis of expenses by both function and nature.

The new standard began taking shape after FASB formed its Not-for-Profit Advisory Committee (NAC) in 2009 in an effort to keep the board informed on non-profit perspectives in financial reporting. The NAC advised that certain areas of the non-profit financial reporting model could be improved.

As an Accountant for a non-profit organization, Board Member, Grant Administrator, Executive Director and especially if you perform audits of non-profit financials it is imperative that you are familiar with these changes, the dates they become effective and any changes to your accounting system (QuickBooks, Sage 50, etc.) that will facilitate these changes.