Allocating Expenses

Expenses are allocated to show the total cost of operating your program(s) that include activities, services, and projects related to a specific program. It is very important for the Executive Director, Board of Directors and other agency management to know the total costs of running the program so all can see how the nonprofit’s resources are utilized.

Expenses that benefit a program or project should be charged to the activity, service, or project according to the relative benefit received.

- Salaries are allocated through using employee and/or consultant time-sheets to record the actual effort, the number of hours, for each employee. Click here to see sample time-sheet.

Free online access to time-sheets and other documents available with purchase of Grant Management Non-Profit Fund Accounting Book

- Non Profit Compliance

- Time-sheets should be reviewed and signed by both the employee or consultant and their supervisor. This review helps ensure the accuracy of the time-sheet and serves as certified time that the grantor may require.

- Fringe benefit expenses are allocated based on salary allocations.

- Expenses for facilities are typically allocated based upon the labor effort for each activity, service, or project. Two frequently used measures of labor effort are *full time equivalents and salaries.

- General and administrative expenses should be shared by all programs or projects where allowed by the grantor.

The basis used for the allocation of expenses must be consistent.

Expense incurred that directly support the program or project and are specifically identified for that program or project are charged directly to the program or project. “NATURAL CLASSIFICATIONS”.

Expenses incurred that are not directly related to program operations or fulfillment but that benefit the program or project are called Indirect Expenses or Indirect Costs.

A cost basis must be established to allocate these costs based on a formula that give fair equity to the program or project.

GAAP requires that expenses are classified based on “FUNCTIONAL CLASSIFICATIONS”.

In addition, a breakdown of functional expenses is required on Form 990, Part IX.

For the majority of nonprofits, the information can be included either in the Statement of Activities, Statement of Functional Expenses or Notes to the Financial Statements.

FUNCTIONAL CLASSIFICATIONS for non-profits generally fall into the following categories:

- Management and general – Costs necessary for the operations of an organization that are not identifiable with a specific program, fundraising or membership activity

- Program – Costs that result in the organization fulfilling its mission and not identified as Natural Classification.

- Fundraising – Costs that involve seeking, soliciting or securing contributions

Though there are existing guidelines, allocating expenses can still be a challenge for an organization.

Common errors found in functional expense reporting include:

- Reporting all expenses as program expenses

- No allocation or inaccurate allocation of personnel costs among programs

- Not allocating insurance, occupancy and depreciation

- Charging all accounting fees to programs

- Incorrectly reporting in-kind donations

- Form 990 functional expense reporting inconsistent with audited or unaudited financial statements

- Waiting until the end of the year to allocate costs in preparation for the annual audit, instead of setting allocation basis and methodology at the program or project onset and evaluating allocation methodology throughout the year

- Use of a arbitrary fixed percentage to allocate costs rather than on a systematic and rational basis

Frequent adjustments of the allocation basis can create problems in identifying the accuracy and acceptable allocation methods being used at any given time:

- Management of the financial results of the programs and/or projects becomes more difficult since the resources available may change because the allocated expenses change.

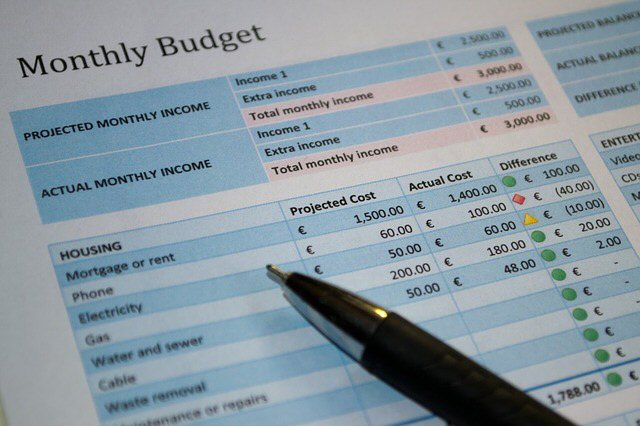

- Budgeting for individual activities, services, or projects and the nonprofit as a whole is more difficult since each new activity, service, or project could have a different allocation basis.

Creating a Functional Expense Process

Putting appropriate procedures in place and providing strong policies to assure they are followed are critical steps in creating a functional expense process. Furthermore, procedures cannot be static. Nonprofits should review their procedures and policies on a regular basis to assure that they are reflecting accurate information.

*Full Time Equivalents (FTE)

An FTE is the hours worked by one employee on a full–time basis. The method is used to convert the hours worked by several part-time employees into the hours worked by full–time employees. On an annual basis, an FTE is considered to be 2,080 hours, which is calculated as: 8 hours per day. x 5 work days per week.