The new due dates will make the K-1s available to the partners and shareholders before their own tax returns are due. In this way, these deadline changes will encourage a more efficient processing of tax returns and will ideally reduce the need for extensions.

Due dates related to individual tax returns and estimated tax payments will remain the same; however, one new date will take effect next year that affects individuals.

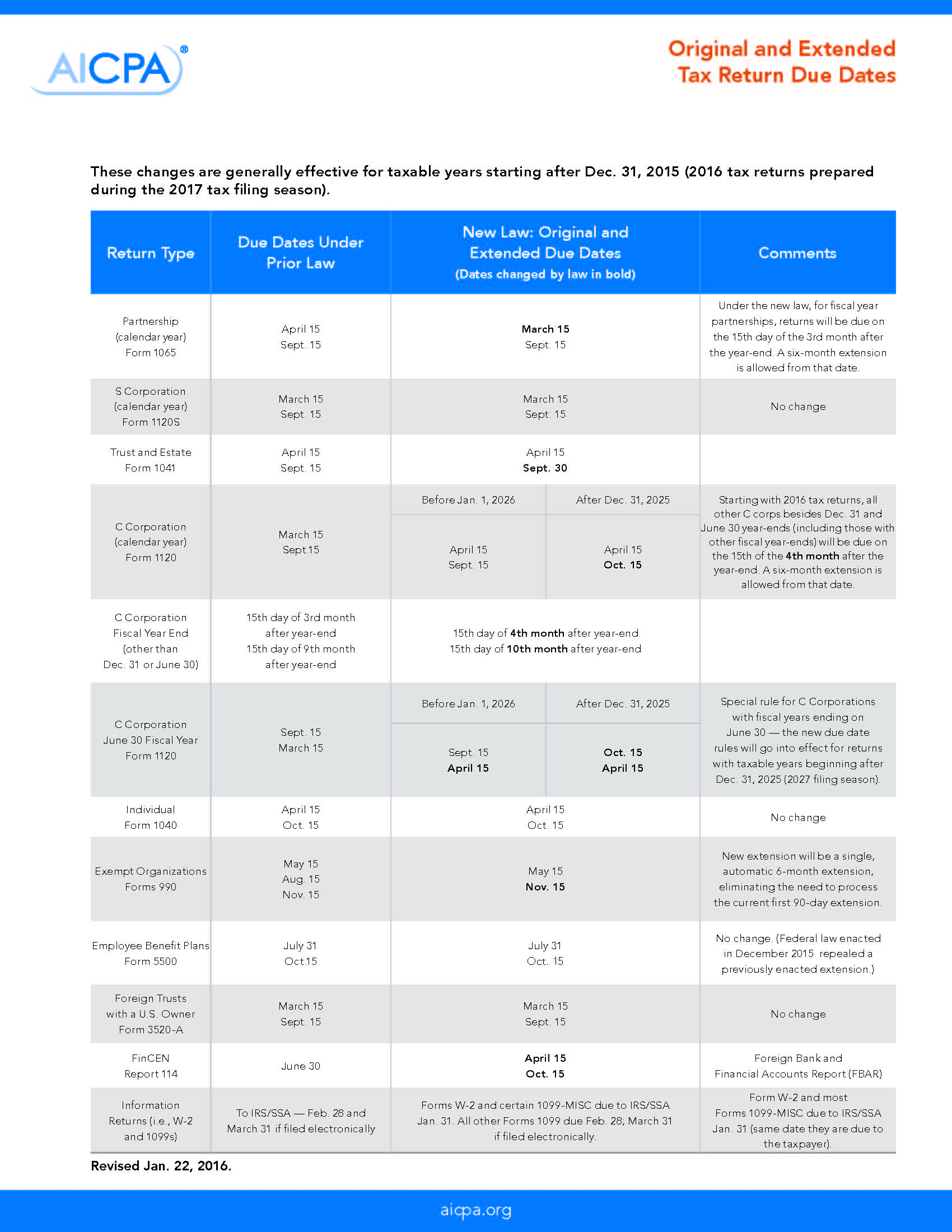

A handy chart with additional details can be found below.

Partnerships (Form 1065) – The due date is moved from April 15 to March 15, or to the 15th day of the third month after year-end for fiscal year-ends. The extended due date for partnerships remains at September 15, or the 15th day of the ninth month after year-end for fiscal year-ends.

C Corporations (Form 1120) — The due date is moved from March 15 to April 15; in most cases, returns will be due on the 15th day of the fourth month after the year-end. The extended due date for C Corporation tax returns will remain at September 15, until the year 2026, when it will move to October 15.

S Corporations (Form 1120S) – No changes. The due date remains at March 15, allowing for preparation of Schedule K-1s as they relate to individuals and organizations. The extended due date for S Corporations remains at September 15. Note that S Corporations usually have calendar year-ends.

Trusts and Estates (Form 1041) – The initial due date for remains at April 15, or the 15th day of the 4th month after year-end for fiscal year-ends. The extended deadline for these returns will move from October 15 to September 30.

Exempt Organizations (Form 990) – The due date remains at May 15, or the 15th day of the fifth month after year-end for fiscal year-ends. The final extended due date remains at November 15, or the 15th day of the eleventh month after year-end for fiscal year-ends. New for the 990 returns is a single, automatic 6-month extension, thereby eliminating the need to prepare the second 90-day extension.

Foreign Bank and Financial Accounts Report (FBAR) (FinCEN Report 114) — This report is required for individuals and businesses with a financial interest in, or signature authority over, at least one financial account located outside of the United States, and the aggregate value of all foreign financial accounts exceeds $10,000 at any time during the calendar year reported. The due date for filing this form is moved from June 30 to April 15; however, now a 6-month extension to October 15 will be available.

Many states are also considering legislation, regulations, or guidance changes to conform state tax return due dates to the new Federal due dates. Some states, including Maryland, have already enacted conformity legislation. Others, including Virginia, already have a state due date of April 15 for corporation tax returns. We can expect to see additional states enacting such changes to their legislation and/or guidance to help taxpayers in the coming months.

Extended Due Dates:

(These dates apply for taxable years beginning after Dec. 31, 2015 [2017 filing season — for 2016 tax returns]).

1. Forms 1040, 1065 and 1120S shall be a six-month period beginning on the due date for filing the return (without regard to any extensions).

2. Form 1041 shall be a 5½-month period beginning on the due date for filing the return (without regard to any extensions).

3. Form 1120 generally shall be a six-month period beginning on the due date for filing the return (without regard to any extensions). Note that Dec. 31 year-end C corporations before Jan. 1, 2026, shall have a five-month extension, and June 30 year-end C corporations before Jan 1, 2026, shall have a seven-month extension.

4. Form 3520, Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts, for calendar year filers shall have due date of April 15, with maximum extension for a six-month period ending Oct. 15.

5. Form 3520–A, Annual Information Return of a Foreign Trust with a United States Owner, shall be the 15th day of the 3rd month after the close of the trust’s taxable year, and the maximum extension shall be a six-month period beginning on such day.

6. Forms 990 (series) returns of organizations exempt from income tax shall be an automatic six-month period beginning on the due date for filing the return (without regard to any extensions).

7. Form 4720 returns of excise taxes shall be an automatic six-month period beginning on the due date for filing the return (without regard to any extensions).

8. Form 5227 shall be an automatic six-month period beginning on the due date for filing the return (without regard to any extensions).

9. Form 6069 returns of excise taxes shall be an automatic six-month period beginning on the due date for filing the return (without regard to any extensions).

10. Form 8870 shall be an automatic six-month period beginning on the due date for filing the return (without regard to any extensions).

11. FinCEN Form 114, relating to Report of Foreign Bank and Financial Accounts, shall be April 15 with a maximum extension for a six-month period ending Oct. 15, and with provision for an extension under rules similar to the rules of 26 C.F.R. 1.6081–5. For any taxpayer required to file such form for the first time, the Secretary of the Treasury may waive any penalty for failure to timely request or file an extension.

Source: aicpa.org