Non-profits have many challenges, ensuring adequate funding is one challenge but operations can be an equally challenging endeavor.

The major interest of funders, donors, board members, communities, beneficiaries, governments or any other interested parties in a non-profit organization is whether the nonprofit has achieved its mission.

Managers of nonprofits have the fiduciary responsibility to efficiently and responsibly manage resources provided by contributors and members efficiently and to facilitate as stewards for those resources, including the responsibility for the overall performance of the nonprofit organization.

This means they also have to measure whether the nonprofit is using the contributed resources effectively and ethically to achieve its mission.

Non-Profit Accounting Challenges

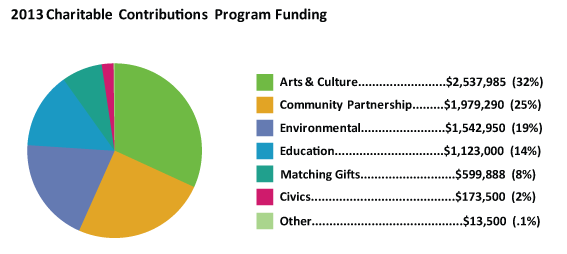

Concerns of interested parties affect the way accountants in nonprofits present financial reports. While for-profit accounting generally has one

equity section, with capital and retained earnings, non-profit accounting must separate this section into net assets and must report each category as unrestricted, temporarily restricted and permanently restricted. In addition, nonprofits must segregate funding source financial details in the financial reports, also separating expenses into administrative, fundraising and program segregation thus increasing complexity.

For-profit corporations do not require this distinction.

This means having to maintain a clear understanding of any contributor or other interested parties

that have imposed restrictions. This is unique to non-profits.

An accountant in a non-profit organization must stay on top of understanding Generally Accepted Accounting Principles (GAAPs), possess, detailed understanding of the reporting requirements of the different stakeholders, including the goals and the mission of the nonprofit itself. Strangely, sometimes varied stakeholder interests even conflict with the GAAPs.

Accountants also must be acquainted with objectives that are beyond the scope of accounting. They have to know the donor reporting timelines, covenants, program delivery schedules, as well as beneficiary and other stakeholder interests and concerns. Accountants must know how their individual actions align with the mission of the nonprofit and contribute to the delivery of the required change.

Another very important consideration is the impact of unethical behavior. While in both for-profit and nonprofit agencies the impact is negative, there are varied dimensions of the same in non-profits; for example while a for-profit may not necessarily have to consult its customers on every decision (though it is good practice) not consulting beneficiaries in non-profits is considered unethical.

Minimizing cost so as to achieve shareholder value through profit maximization may be comfortable in for-profit entities, but may not be considered ethical in nonprofits. Spending less to increase surplus is usually not acceptable in nonprofits because the objective is rarely to have more money left but utilize funds to meet the nonprofit’s mission.

Having big cash balances (low burn rate) so as to “save” will not only impair the financial sustainability but also diminishes the organization’s credibility among stakeholders and endangers its long-term mission achievement, thereby bringing to question the nonprofit’s going concern standing.

Whatever the mission statement outlines as the ultimate goal, the performance measurement system needs to ensure that the impact of unethical behavior is measured and reported, in both financial and program impact terms.

The challenges in effectively managing nonprofit organizations are complex, and not easily compared with the for-profit sector. A finance professional in a nonprofit organization has to be more than a number cruncher. He or she has to be apt in understanding the organization’s mission, being sensitive to the varied stakeholder interests and consciously aligning his actions and counsel to the desired change.

This brings to point a very important concern I have experienced with nonprofit organizations both small and mid-sized. One of the more important considerations I have seen, that is not taken into account, when looking to hire an accountant is not considering the experience of the potential employee or contractor with specifically nonprofit accounting.

Nonprofit accounting is different from for-profit accounting. I have seen some real problems with fiscal reporting and lack of knowledge in program and agency measurement reporting. These are very important skill sets that the accountant must demonstrate to properly provide fiscal and in smaller organizations program reporting.

I am not saying that there aren’t any accountants whose experience is in the for-profit business sector, but I am saying choose your accountant carefully and mindfully.

You may spend more time recruiting good applicants for your finance team than you may spend for program staff. Competition for strong candidates can be challenging.

Below are some suggestions:

- Ask your auditor: Your auditor not only is connected with the accounting world but also understands your needs. Auditors may know of good candidates who may be looking for work; for instance one of their other nonprofit clients may have just downsized. Be sure to ask for other places to recruit in your community.

- Advertise in different places

- On Craigslist, post the position both in the nonprofit section and in the accounting and finance section. For that listing, don’t simply say “we’re a nonprofit;” say “agency working against AIDS.”

- For some lower-level positions, send an announcement to the career services department and the accounting department at local colleges. Some colleges offer career services for alumni as well.

- Announce broadly: Let your peers know that you are recruiting. Announce it at nonprofit meetings and other gatherings you attend. Send out emails to your colleagues in the sector, and ask staff to send out emails as well.