Welcome to our new site. We are working to complete all the elements of our site but feel free to visit our blog or contact us.

Nonprofits are Important to our Community

Nonprofit organizations are essential to our quality of life because of the valuable programs they provide local citizens and the positive economic impact within our local communities.

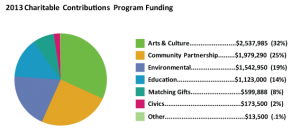

Nonprofit organizations play a growing role in the social and economic well-being of the United States. They provide services, goods, and resources to meet community needs. They are businesses, most often charitable, that assist other organizations in the community to drive economic development, the arts, cultural awareness, education, health, and spirituality — virtually every sector of society. As government agencies and the private sector have scaled back their charitable giving in recent years, nonprofits have become indispensable.

It is very important that your organization remains in compliance with non-profit rules and regulations so you cn continue to be an integral contributor to the health and welfare of our society and be able to give others the means to help those who are not as fortunate as others by giving them reliable resources to help.

Grant Management Non-profit Fund Accounting is a requirement for non-profit organizations that we cannot get around and expect to keep or increase funding for our projects. This site is designed to introduce an invaluable resource to new start-ups, existing organizations, board of directors and others on how to setup and maintain compliance systems for funding sources and donors.

Why is this information Important? Non-profits have very specific compliance and governance regulations. This book will assist in ensuring organizations have the resources and information required to track grant expenditures, create meaningful reporting and maintain records for agency decision making.

Funders require detailed reporting of how grant funds are spent. In addition to deliverables funders review financial statements and budgets to determine if an organization is fiscally sound and spending grant funds according to the agencies stated purpose.

Start-up organizations as well as established charities will benefit from plain and simple illustrations and instruction on how to set up fiscal and document systems, helping to ensure compliance with federal, state, local and private grant makers.

We have made this book affordable to give you the basic information you will need and included in the book are links to free forms for your use. You will gain great insight into the reporting requirements, accounting requirements and you will be able to provide periodic status report on the agency’s health

Donors, grantors, boards of directors, and regulators all expect a full accounting of how your organization uses money. Fund accounting is an accounting method that groups assets and liabilities according to the functional purpose for which they are to be used.

The skills and information you will get from this guide will help to ensure you are prepared for your A-133 Audit and much more.

In today’s complex regulatory environment, nonprofit organizations face an ever-evolving landscape of legal and ethical requirements. The Nonprofit Compliance Reference Guide is an essential resource for nonprofit leaders, board members, compliance officers, and legal professionals seeking a clear, comprehensive understanding of compliance obligations.

Recent Posts

Non-Profit Accounting Challenge

Non-profits have many challenges, ensuring adequate funding is one challenge but operations can be an equally challenging endeavor. The major interest of funders, donors, board members, communities, beneficiaries, governments or any other interested parties in a non-profit organization is whether the nonprofit has achieved its mission. Managers of nonprofits have the fiduciary responsibility to efficiently

IRS Tax Calendar for Businesses and Self-Employed

Online Calendar View due dates and actions for each month. You can see all events or filter them by monthly depositor, semiweekly depositor, excise, or general event types. Visit this page on your Smartphone or tablet, so you can view the Online Calendar on your mobile device. View the Tax Calendar Online (en Español) Calendar

Updated Resource Center

First I would like to thank all of you for the support you have given this site. As I have said before I strive to provide only information that I believe will be of value to my readers. Saying that, I will not be posting to fill space or to show that I can post

Budget for Government Grants

Budget for Government Grants Posted: June 6, 2009 Shawn H. Miller, CPA, CFE Calibre CPA Group PLLC This article was posted by Mr. Miller on the Non Profit Accounting Basics website in 2009 and is still very much prevalent today. When you receive a grant from a governmental agency, it will typically include a program

How Not-for-Profits can stay strong amid uncertainty

This is a re-post from Journal of Accountancy that I would advise you subscribe to for updates on various issues that will affect non-profits. Here is the article: Not-for-profit executives and finance teams—and the boards that oversee those organizations—are facing challenging times. In addition to the uncertainty of the upcoming U.S. election, they are confronting

Cost Sharing/Matching Requirements

Cost sharing or matching is the financial support contributed by organizations to sponsored projects. Compliance with federal cost accounting standards requires that cost-shared expenses be treated in a consistent and uniform manner in proposal preparation, award negotiation and the accounting of these expenses in the financial reports to sponsors. Your organization should assume a cost-sharing