A CHECK SIGNER’S RESPONSIBILITIES

Most businesses know that segregation of duties is an essential internal control within the accounting function. So, normally, the person with check signing authority is someone different from the person generating the checks within the accounting program. But this example of segregation of duties only works well if the check signer provides the necessary oversight over those checks being signed. How does he/she do that? Here are some points to consider when you are signing checks:

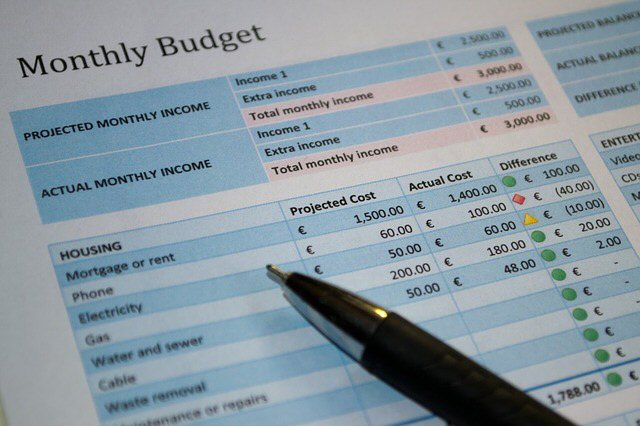

- Be sure that backup documentation is attached to support the check.

- Review this documentation and compare to the check:

– Does the amount agree?

– Does the vendor name agree?

- Review the documentation to ensure that it is a reasonable and expected business expense and that is it supportive of your overall mission:

– Does the support show the required approvals?

– If you use purchase orders, is an approved purchase order also attached?

– If the invoice is for physical items, is the delivery address the same as the business address?

– If the invoice is for services, does the amount agree to any contracts that may relate to the service? Does the invoice clearly state the services being provided?

– Are there original receipts to support expense reimbursements? Do expense reimbursements charges look reasonable and were they properly approved?

– Does the backup look legitimate?

- Ensure that the supporting documentation includes the original invoice, and not a copy. There should be a company policy on this to prevent duplication.

- Ensure that the supporting documentation is an invoice, and not a monthly statement. There should also be a company policy on this.

- If you are not familiar with the vendor or the charges, go a few steps further in your review…make inquiries, ask for additional backup, talk to others involved, etc. Do what you need to do to ensure that the charges are legitimate. Don’t automatically trust the response from the person who generated the check.

While you are performing these reviews and comparisons, consider that a common fraud scheme is when a bookkeeper/accountant sets up a personal bank account using a fictitious vendor name that may be very similar in name to a real vendor that your organization uses. Then the bookkeeper/accountant can generate checks/payments to that vendor (with a slight name change), obtain the signature, and deposit them into this personal account. If the policies exist prohibiting the use of copies of invoices or statements, you can lessen the risk of this kind of scheme being successful.

Resource for Fiscal Compliance

You will find this book to be invaluable when setting up and maintaining your systems for non-profit finance, compliance and reporting and organizational status reports to your Board of Directors and other interested parties. In addition to performing deliverables, as specified in your program plan, timely and effectively, you should not have to worry about discontinued funding due to non-compliance.