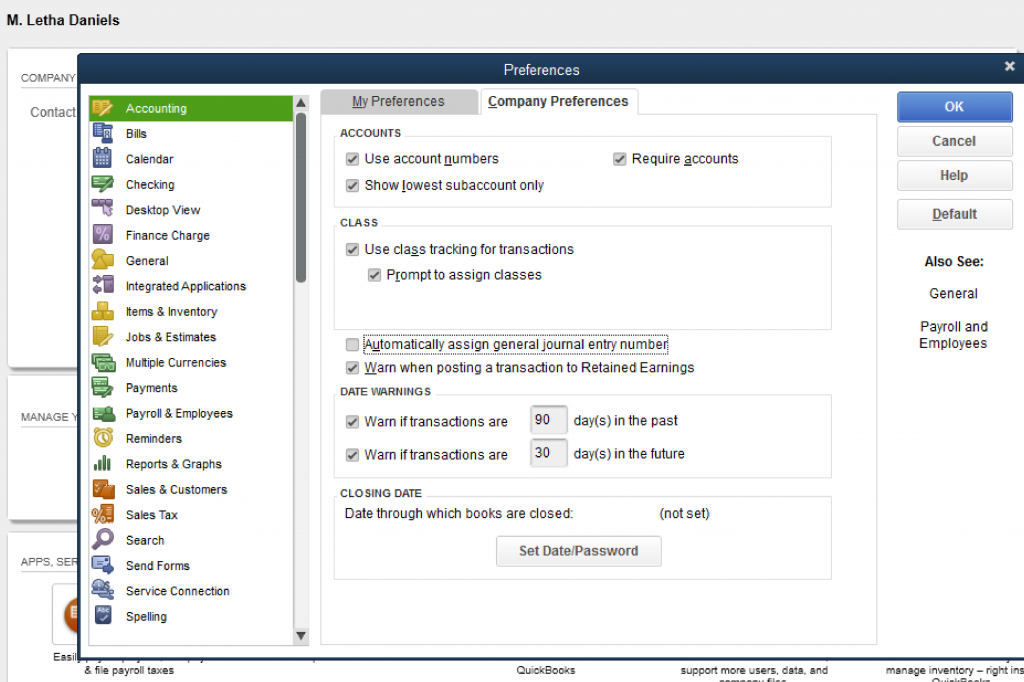

QuickBooks has many limitations in all versions of their products, especially where the non-profit versions are concerned. The Grant Management Non-Profit Fund Accounting book focuses on only one of those peculiarities.

One of QuickBooks’ peculiarities that is covered and that those who use QuickBooks non-profit have to live with or find a work around is recording revenues on an accrual basis. The grant management book shows QuickBooks defaults to recording income on a cash basis on the balance sheet.

When vendor bills are entered to QB (payables), QB defaults to the expense tab when the amount payable is enter with all the payable details. These bills may or may not be charged to the funding source.

If the bill is charged to a funding source and you create an invoice for the funder this method does not credit revenue and debit accounts receivable, instead it debits accounts receivable and credits the expense account charged when the payable was entered, netting a zero balance for this particular entry.

When cash is received from your funder and you enter it to QB, QuickBooks records the cash receipt as a debit to cash or un-deposited funds (based on how you have payment preferences setup) and credit to accounts receivable as expected.