The Uniform Grant Guidance (2 CFR 200) is a set of regulations that govern the administration of federal grants to non-profits in the United States. These regulations are intended to ensure that federal grant funds are used effectively and efficiently to achieve the intended outcomes and objectives of the grant program.

One of the main purposes of the Uniform Grant Guidance is to establish common rules and requirements for non-profits that receive federal grants. This includes provisions related to eligibility, allowable costs, cost principles, and reporting requirements.

For example, the Uniform Grant Guidance outlines the criteria that non-profits must meet in order to be eligible for federal grants. This includes requirements related to organizational capacity, financial management, and programmatic experience.

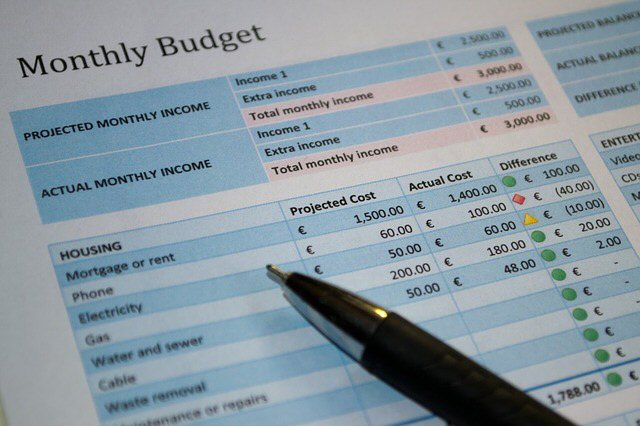

The Uniform Grant Guidance also provides guidance on what types of costs are allowable under federal grants. This includes direct costs, such as salaries and wages, as well as indirect costs, such as rent and utilities. Non-profits are also required to follow principles for determining the allowability, allocability, and reasonableness of costs incurred under federal grants.

In addition to these requirements, the Uniform Grant Guidance includes provisions related to time and effort reporting, financial and performance reporting, auditing, suspension and debarment, conflict of interest, and data management. These requirements are designed to ensure that non-profits are accountable for the use of federal grant funds and that they are managed in a transparent and responsible manner.

Overall, the Uniform Grant Guidance plays a critical role in ensuring that federal grant funds are used effectively and efficiently to achieve the intended outcomes and objectives of the grant program. By following these regulations, non-profits can help to ensure that they are able to effectively serve their communities and achieve their mission.