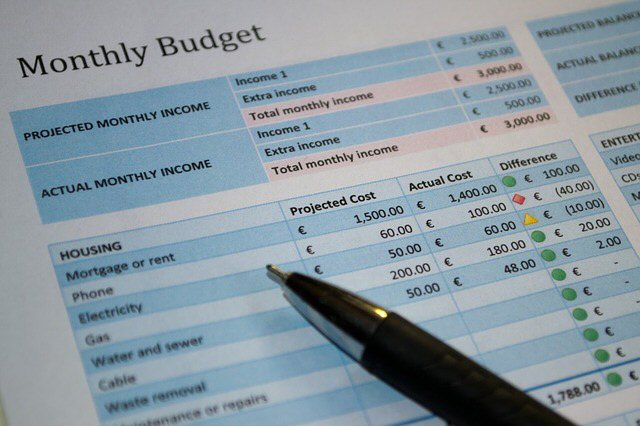

You will be able to manage, prepare and maintain fund balance reports manually or with a computerized accounting system. Prepare for A-133 audit requirements of some non-profit organizations depending on size of federal funding, and prepare and support grant fund allocations for funding sources. You will also learn to provide fund reports to management, auditors, funding sources and the board of directors, work with the executive director and project managers in understanding the financial aspects of the program and become aware of the need for budget revisions.

Most all Funding sources (Grant providers) have very specific reporting requirements in accounting for funds you have received from their sources. These funds are generally obtained from a Federal, State, Local government and/or private sources designating your funding as the administrator of these grants.

The accountability for the funding is designed and regulated by various government entities.

OMB (Office of Management and Budgets), GAAP (Generally accepted Accounting Principles), FASB (Financial Accounting Standards Board) and other governing bodies set the guidelines for all accounting principles and regulations

The skills and information you will get from this book will help to ensure you are prepared for your A-133 Audit, provide documentation of receipts and expenditures from your funding sources, provide the organization with invaluable information on the performance of your programs, and help to determine when budget revisions are required. Accurate accounting for funds received can be a determining factor in ongoing funding for your programs; therefore, it is imperative that the methods used to account for grant funds received are in compliance with the guidelines set by the governing entities and/or funding sources in the case of restricted funds received from private donors.

As an accounting professional, executive director, board member or project manager you will greatly benefit from the information contained in this guide.

Included are worksheets that you can use for your organization or use to prepare preliminary information to be transferred to an electronic system of accounting and document maintenance such as Excel, Word and others.

Click here to Read an excerpt from the Grant Management Non-Profit Book

Resource for Fiscal Compliance

Grant Management – Non Profit Fund Accounting

You will find this book to be invaluable when setting up and maintaining your systems for non-profit finance, compliance and reporting and organizational status reports to your Board of Directors and other interested parties. In addition to performing deliverables, as specified in your program plan, timely and effectively, you should not have to worry about discontinued funding due to non-compliance.