This can actually happen to you.

Your finance committee or board meets. The members are presented with a packet of information that includes financial reports prepared by your accounting department and reports prepared by your development department. As the members review these reports, they notice the contributions from your accounting department do not agree with the donor numbers from your development department. Questions are asked, the staff tries to explain, and everyone is bewildered.

Shouldn’t the two sets of reports contain the same information? Is one set of reports right and the other wrong?

Well, not necessarily, but the differences between the two can be confusing and, if inadequately explained, often embarrassing. A second related question concerns the potential inefficiencies of recording information twice. This will be addressed at the end of this article.

All nonprofit organizations have some kind of accounting system. Many, if not most, nonprofits also have a donor database. Can or should these parallel systems talk to each other? This article will discuss the basic issues.

Nonprofits typically receive grants, contributions, donations, pledges, gifts in-kind, sponsorships, etc. These sources of revenue may come from foundations, corporations, individuals, and governments.

Your accounting department will record this revenue in its accounting system. If your organization has a separate donor database, someone in your organization, perhaps in your development department, will also record this revenue information in the database.

If the same information is being recorded in two different places, why (unless someone makes a data entry mistake) might the two systems report different revenue numbers?

The answer is that generally accepted accounting principles (GAAP) rules require general ledger information to be entered one way, but there are situations where the development department may need to enter the information in a different way. Though reports generated by the accounting and development departments may vary, it is quite possible neither one is wrong.

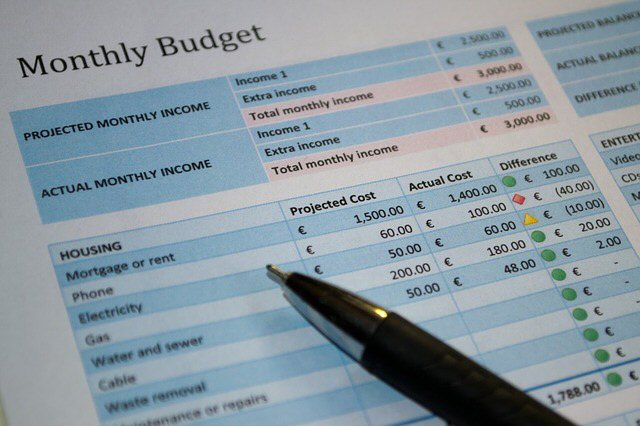

For example, suppose a donor sends a check for $10,000 to pay a pledge the donor made in a previous period (such as last month, or two months ago, last year, etc.). The development department enters this $10,000 in the donor database and at the end of the month will produce a report including this $10,000 in their list of contributions.

The accounting department, on the other hand, will apply this $10,000 against a pledge receivable recorded in the previous period. If your accounting system is on an accrual basis, it counts revenue as of when the pledge was made, as opposed to the development department, which might be on a cash basis and logs its donations when the checks actually arrive. Since the revenue from this pledge was already recorded in the previous period, no new revenue results from the receipt of this check. So when the accounting department produces its Statement of Activities, it shows no revenue while the development department report shows $10,000. The reports seem to be off by $10,000, yet no one actually made a “mistake.”

Another common example of different treatments of the same transaction can occur with grants. A grant letter typically spells out the terms, restrictions, and conditions, if any, of the donor. For example, say a foundation awards your organization a grant for $100,000. The development department will want to carefully track this grant through its donor database. Reports will be printed showing the receipt of this grant.

The accounting department, however, has to follow GAAP. For example, this $100,000 grant may have a condition attached, such as the need for some uncertain event to occur in the future. This condition may preclude this grant from being recorded in the accounting system until the condition is resolved. This creates the potentially bizarre situation of the development department reports showing $100,000 of revenue while the accounting reports show zero!

So how do we solve this problem?

The finance committee must be given information that is clear and unambiguous. Presenting them with reports showing seemingly conflicting information is not satisfactory. What can be done about this?

The answer lies in two parts: Part one is better communication between the accounting and development departments. Specifically, there needs to be a clear set of policies and procedures so both departments understand how to treat various types of contributions. Furthermore, the donor database and the accounting general ledger, the place where accounting information is stored, should be set up so they are in alignment with each other. For example, if the accounting system uses account number 4500 to designate corporate contributions, then the donor database must also use account number 4500 to designate corporate contributions.

Part two of the answer is that both the accounting system and the donor database must be reconciled to each other at least once per month.

With a cooperating accounting department, and with a cooperating development department, along with support from the organization’s management and executive director, this communication and alignment is very doable and can be accomplished relatively easily, in addition this cooperation should be documen ted in the accounting procedure manual.

ted in the accounting procedure manual.

Once the issue of conflicting data is addressed, the next issue to address is the potential inefficiency of entering contributions twice; once in the accounting system and once in the donor database. For example, if your organization receives 100 donor checks per month, is there a way to avoid having two people entering each check in both systems? Can this duplicate entry be avoided?

The answer is yes.

The solution involves establishing a disciplined process in which all the contribution details are entered into the donor database, with only summary information posted to the accounting general ledger. For example, assume an organization receives 10 donations on a given day. Each of these donations must be entered in the donor database so that the development department has all the information they need to track the donors, send them thank you letters, follow up with them, etc.

Once these contributions are all entered, a summary report can be printed from the donor database showing the total dollars by account distribution. Seven of the checks might have been individual contributions, so they can all be summed into one number. The other three might have been foundation grants, and they can be summed into one total as well.

Your accounting department can take this summary report and enter a single journal entry to record the day’s contributions. The double entry problem is effectively eliminated. Note again, though, that a monthly reconciliation must be done to insure the integrity of the information in both systems.

Up until this point, we have described how an organization can perform quite nicely with two separate systems: one for accounting, and one for donor data. However, would an integrated system be more efficient?

By an integrated system we mean a single piece of software that will handle both your organization’s accounting and donor data needs. The theory is you enter a contribution once and you are done.

The answer is generally yes, an integrated system would be preferable. However, it depends on the system as some are marketed as being integrated when they are really not. It also depends on price and sophistication, as some integrated systems might be unnecessarily expensive and complicated to use.

Integrated systems still require communication between the development and accounting departments. There still needs to be a disciplined set of policies and procedures governing how contributions are recorded. There still needs to be a single chart, or list, of accounts that both departments use. And there needs to be consistency around the use and understanding of financial terms such as knowing when a cash receipt is revenue for this period versus payment on a pledge from a previous period. There still needs to be an accepted understanding of how and when to recognize revenue on conditional grants.

For these reasons, it is advisable for organizations that have separate accounting and donor systems to delay spending more money on an integrated system. The essential first step is to get the development and accounting department to communicate about the issues described above.

Once all the necessary policies and procedures are in place and things are running smoothly, then a proper cost-benefit analysis can be done on whether or not to move up to an integrated system.

Resource for Fiscal Compliance

You will find this book to be invaluable when setting up and maintaining your systems for non-profit finance, compliance and reporting and organizational status reports to your Board of Directors and other interested parties. In addition to performing deliverables, as specified in your program plan, timely and effectively, you should not have to worry about discontinued funding due to non-compliance.