2019 Mileage Tax Deductions

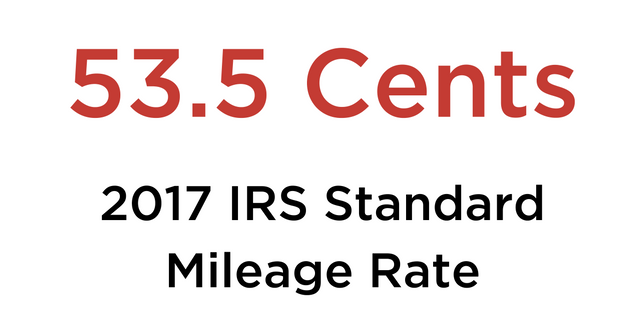

Source: 2019 IRS IR-2018-251, December 14, 2018 WASHINGTON — The Internal Revenue Service today issued the 2019 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Beginning on Jan. 1, 2019, the standard mileage rates for the use of a car (also vans, […]

2019 Mileage Tax Deductions Read More »